by eespin | Advertising, Articles, SEO

“Ladies and gentlemen, I’m not in the hamburger business. My business is real estate.” Excerpt from Rich Dad: “In 1974, Ray Kroc, the founder of McDonald’s, was asked to speak to the MBA class at university of Texas at Austin… After a powerful and inspiring talk, the...

by eespin | Social Media, Webinar

Most title agents use social media all wrong! Setting up your social media profiles doesn’t need to be difficult or time consuming. Yet many title agents fail to do just a few critical things that would reach more real estate agents, lenders and local home...

![[Video] How One Title Agent Went From Zero to Page 1 of Google in 30 Days!](https://titletap.com/wp-content/uploads/2016/07/Title-Company-Video-Screenshot-1.png)

by eespin | testimonials, Video

Video Notes: 5:15 – Fixing the disconnect between your company and your online presence 6:45 – Video / Blogging results 8:15 – Search engine ranking improvement in under 10 minutes a day 10:20 – ROI of marketing title insurance online...

by eespin | Advertising, Articles, Pillar 3 Best Practices

MPA magazine featured a great article on how industry marketing vendors must be focused on compliance. This is becoming true not only for the mortgage industry, but anyone regulated by the Consumer Financial Protection Bureau, including title agencies. Vetting vendors...

by eespin | Articles, Coaching, Sales Process:

Your current customers and clients are your biggest fans…are you asking for referrals on a consistent basis? If not, it’s time to get busy! The advantages of working by referral are obvious, so why don’t we do it more often? It’s incredibly cost effective, it...

by eespin | Advertising, Not Just Optional, Title Insurance Podcast

So everyone in the real estate, mortgage, and title business knows that there have been some massive compliance changes like TRID. The big question is how do you use these industry regulations to drive more revenue? Old-time marketers tell you that the best way to...

by eespin | 7 Website Best Practices, Advertising, Articles, Social Media, TRID

TRID and the CFPB aren’t the only things that have changed the title industry over the past year. Marketing your title agency has changed as well by moving away from pens and donuts. Here are 6 things you need to be doing in 2016 and beyond to market your...

by eespin | Press Releases

TitleTap announces a social media management service due to growing customer demand. Tampa, FL: TitleTap, the leading provider of websites and turn-key marketing tools for Title Agents and Attorneys, announced in March 2016 at ALTA Business Strategies the release of...

by eespin | Advertising, Articles, Social Media

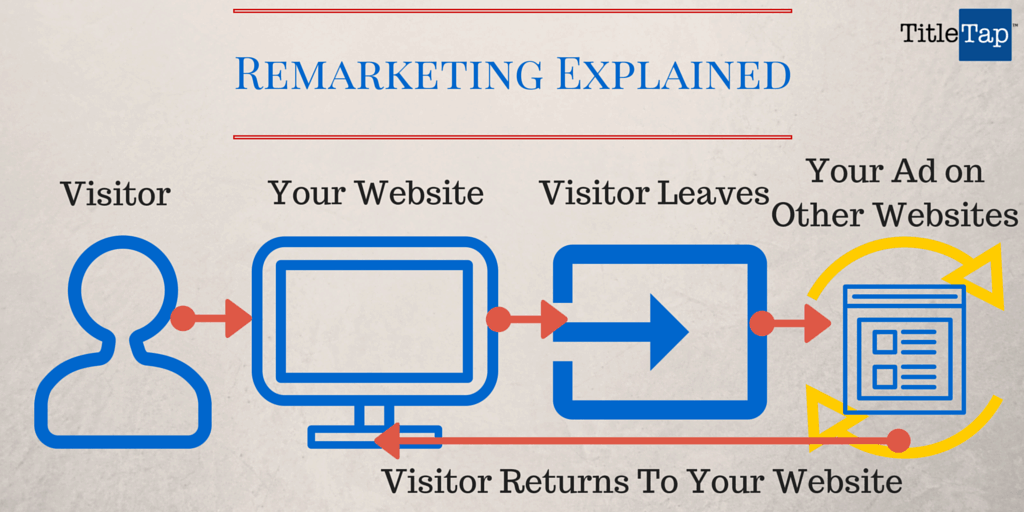

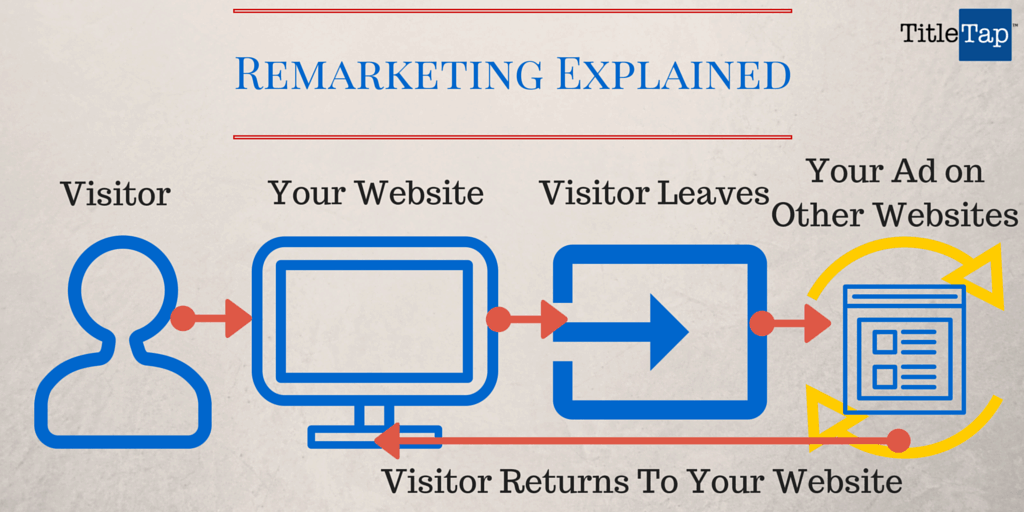

Remarketing (or retargeting) is something no one in the real estate industry is doing but everyone should be. Not only is it super effective, it is typically inexpensive too! What is retargeting? Have you ever been to a website or put a product in your cart, then...

by eespin | Articles, Social Media

Having a Facebook profile is one thing. Actually using it is another. Did you know Facebook Ads can actually make your Law Firm and Title Company visible to people with very specific interests and demographics? A couple things to note: Facebook now has more active...

![[Video] How One Title Agent Went From Zero to Page 1 of Google in 30 Days!](https://titletap.com/wp-content/uploads/2016/07/Title-Company-Video-Screenshot-1.png)