![Use Content to Boost SEO And Organic Traffic: 3 Strategies [Webinar]](https://titletap.com/wp-content/uploads/2020/11/content-is-king-1132259_1920-1.jpg)

by eespin | Advertising, Attorney Marketing, Attorneys, Blogging, Commercial, Content Marketing, FAQ, Finding:, Going To Market:, Law Firms, Marketing, News, SEO, Social Media, Title and Closing:, Title Companies, Video, Webinar, Website Design, Website Development

Right now, there is a prospect in your market, looking for the services you offer, online. But how do you get them off Google and onto your website? One of the most effective methods to drive organic traffic to your title company or law firm, is to have quality...

by eespin | Attorney Web Design, Attorney Website Design, Web Design, Website Design, Website Development

We are excited to announce four new website designs, specifically tuned to law firms and title insurance companies. The new designs can be seen here, here, here and here. They include some popular website design elements for attorneys and title insurance companies...

by eespin | Advertising, Attorney Marketing, Attorney Web Design, Attorney Website Design, Attorneys, Content Marketing, Law Firms, Marketing, SEO, Web Design, Website Design, Website Development

When you run a solo law firm, you aren’t just doing billable client work. You are also responsible for growing and managing your business. This means that in addition to being an attorney, you are also the number one salesperson, marketer, customer support rep,...

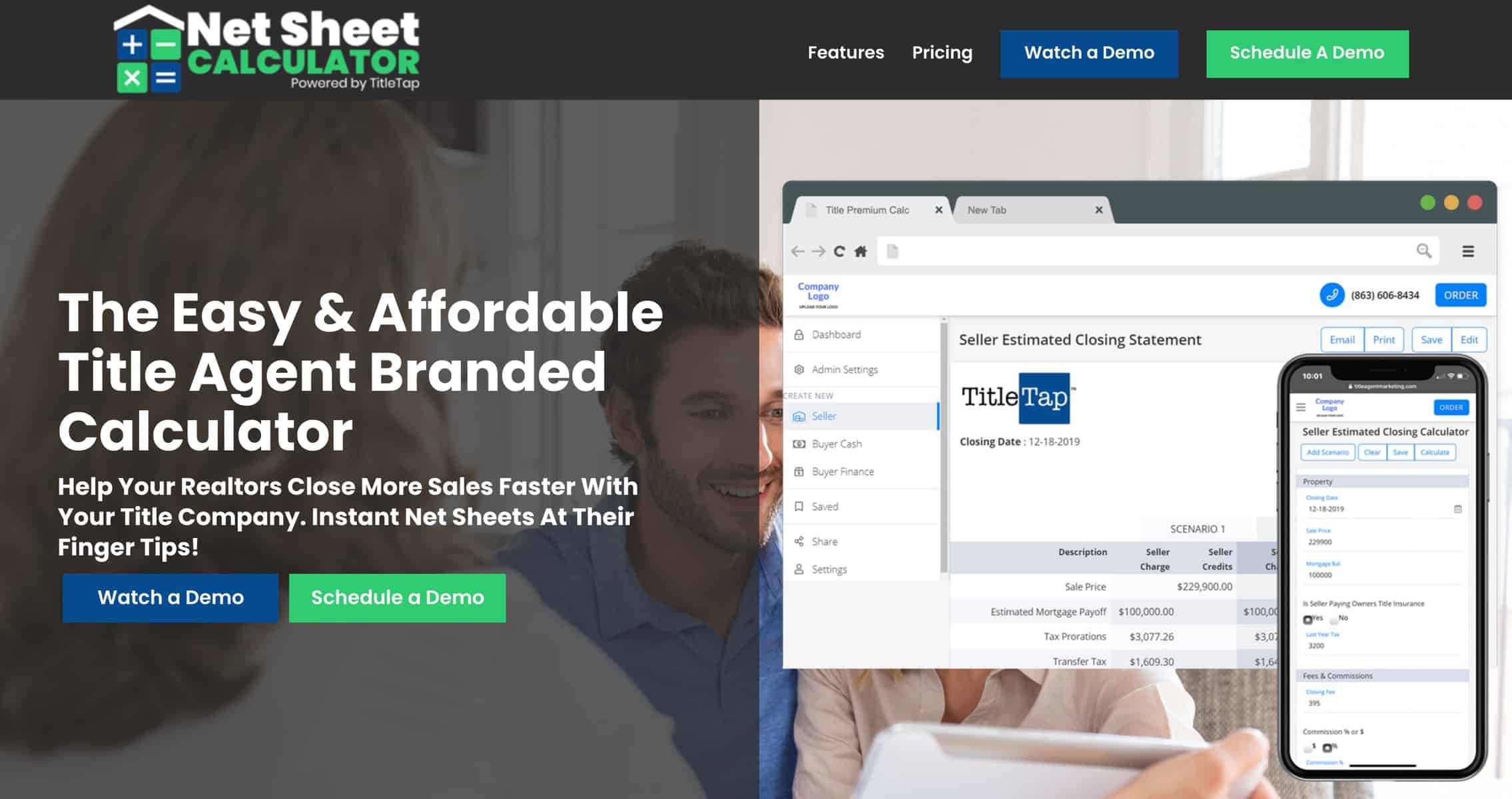

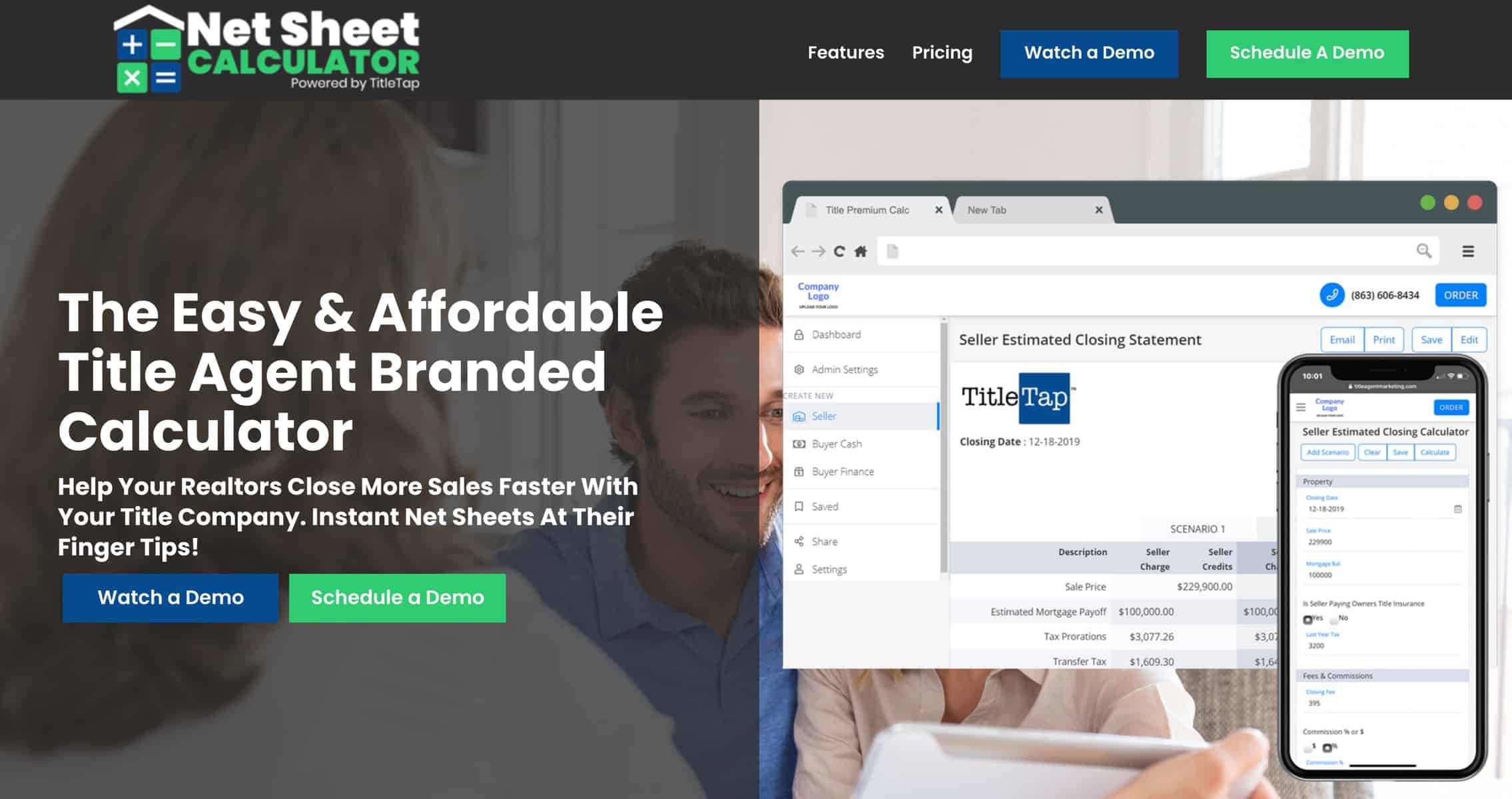

by eespin | Calculator, net proceeds sheet, Net Sheet Calculator, Press Release, Press Releases, Seller Net Sheet, Title Insurance Calculator, Title Policy Calculator

TitleTap is proud to announce that we have launched a brand new version and branding of our Net Sheet Rate Calculator! Our new version has some amazing benefits that were added from direct feedback by the hundreds of title agents and attorneys that use this solution...

by eespin | Advertising, Attorney Marketing, Attorneys, Law Firms, Marketing

Running a solo law firm can be rewarding, but it also comes with its own set of challenges. You have the freedom to build the practice that you want. You also have the responsibility of getting new clients in the door. In our digital marketing guide for attorneys, we...

by eespin | Advertising, Attorney Website Design, Attorneys, Law Firms, Web Design, Website Design, Website Development

While you shouldn’t get creative and fancy when writing legal agreements, contracts, and documents, there is a lot more freedom and flexibility with your website. In fact, your website is a chance to show off your personality, what makes your firm unique, and why your...

by eespin | Google Reviews, Online Reviews, Star Ratings, testimonials

Title and settlement agency customers can provide reviews for the web and social media through direct links within ResWare’s automated emails. Superior, CO, (October 6, 2020) – Adeptive Software, developers of the powerful title and escrow production software,...

by eespin | Attorney Web Design, Attorney Website Design, Attorneys, Law Firms, Web Design, Website Design, Website Development

What does it cost to create a great attorney website? Unfortunately, there is no straightforward answer. Many factors go into designing an attorney website, from known costs like website hosting to hidden costs like the time it takes to learn how to create and build...

by eespin | Advertising, Attorney Marketing, Attorneys, Content Marketing, Marketing

Nobody wants to think about death, especially their own, which is why many people try to avoid it. As an estate planning attorney, you know there are a lot of benefits to getting your affairs in order – even if it may be uncomfortable. You need to emphasize with...

![Selecting and Marketing Your Title Quote Calculator [Webinar]](https://titletap.com/wp-content/uploads/2020/09/Depositphotos_222091118_xl-2015-copy-1.jpg)

by eespin | Attorney Marketing, Attorneys, Calculator, net proceeds sheet, Net Sheet Calculator, Seller Net Sheet, Title and Closing:, Title Companies, Title Insurance Calculator, Title Policy Calculator, Video, Webinar

Recently, our team shared some tips for selecting and marketing your Net Sheet or closing cost calculator tools, along with some resources that many websites aren’t fully utilizing. Click here to watch the full webinar! Leveraging Your Calculator Selecting The Right...

![Use Content to Boost SEO And Organic Traffic: 3 Strategies [Webinar]](https://titletap.com/wp-content/uploads/2020/11/content-is-king-1132259_1920-1.jpg)

![Use Content to Boost SEO And Organic Traffic: 3 Strategies [Webinar]](https://titletap.com/wp-content/uploads/2020/11/content-is-king-1132259_1920-1.jpg)

![Selecting and Marketing Your Title Quote Calculator [Webinar]](https://titletap.com/wp-content/uploads/2020/09/Depositphotos_222091118_xl-2015-copy-1.jpg)