by eespin | Advertising, Articles, Compliance, Cyber Security, Marketing, Security, SEO, Web Design

Your clients trust you to be professional and look out for their best interests. But could your website be dropping the ball? If you don’t have a secure website, the answer might be yes. Without SSL it can be ridiculously easy for hackers to “listen” to...

by eespin | 7 Website Best Practices, Articles, Case Study, Cyber Security, Pillar 3 Best Practices

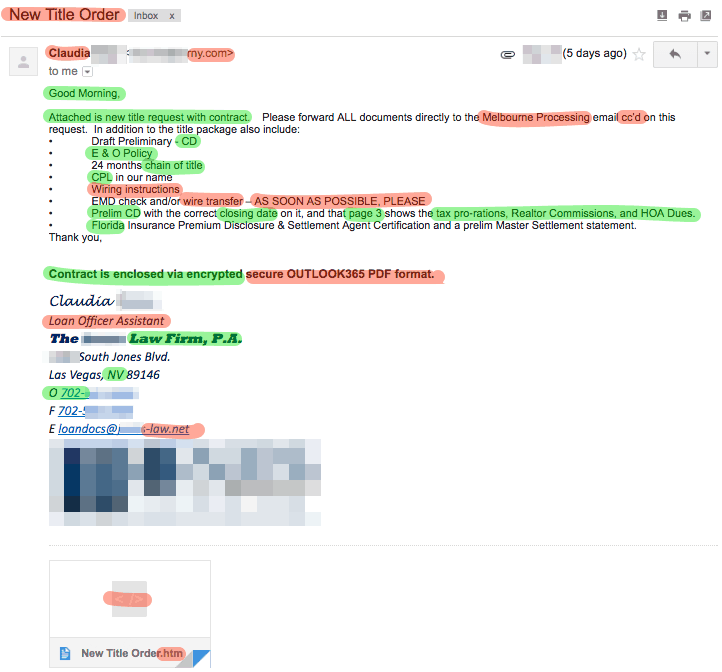

With wire fraud at a record high, most industries are getting more strict with security requirements. This includes the land title industry. And with good reason – according the FBI, almost $1 billion was “diverted or attempted to be diverted” from real estate...

by eespin | Articles, Cyber Security

Note: The following is for educational purposes only. We are not law enforcement or lawyers and this is not legal advice. You should always consult with law enforcement, your legal counsel, insurance providers, and respective underwriters to make sure you adhere to...

by eespin | Compliance, Cyber Security, Pillar 3 Best Practices

Real estate transactions are some of the higher value transactions commonly done by individuals and companies. As such, they have become an increasing large target for hackers. The way a typical scam works is first the hacker gains access to the email of one of the...